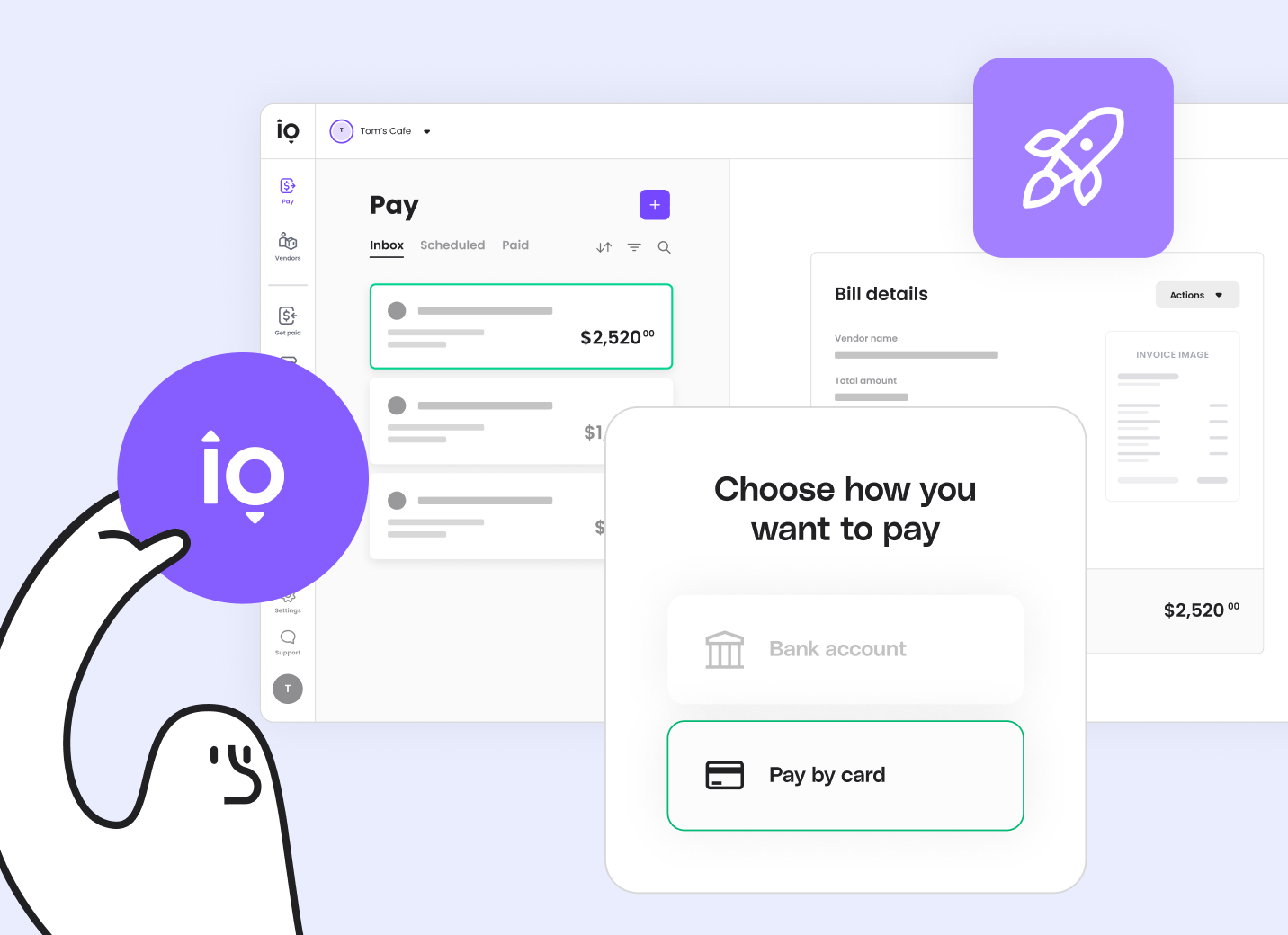

Managing payments is one of the biggest pain points for small and medium-sized businesses (SMBs). Melio, a modern B2B payment platform, is changing that by offering a streamlined, flexible, and digital-first approach to bill payments. In this article, we’ll explore how Melio simplifies business payments for SMBs and why it’s becoming a go-to tool for smart entrepreneurs.

What Is Melio?

Melio is a digital B2B payments platform designed specifically for SMBs. Founded in 2018, it enables business owners to pay vendors and contractors via bank transfers or credit cards—even if those vendors only accept checks. It’s free to use for standard ACH payments, and it offers a simple interface to digitize bill payments and accounts payable processes.

Key Features That Simplify Payments

1. Pay by Credit Card (Even If Vendors Don’t Accept Them)

Melio allows you to pay bills with a credit card even if your vendor doesn’t accept cards. Melio converts the card payment into a mailed check or ACH transfer on your behalf. This gives you flexibility and helps manage cash flow by leveraging credit.

2. No Monthly Fees

Unlike many payment platforms, Melio has no subscription fees. Most of its essential features—including check mailing and bank transfers—are free to use, making it a great option for budget-conscious SMBs.

3. Paper Checks and ACH Transfers

Melio bridges the digital gap with vendors by supporting both paper checks and ACH payments. You upload the invoice, schedule a payment, and Melio takes care of printing, mailing, or electronically transferring funds.

4. Bill Scheduling and Reminders

Melio lets you schedule payments in advance and set up auto-pay for recurring expenses. Never miss a bill deadline again—this is perfect for managing rent, utilities, and supplier invoices.

5. QuickBooks Integration

Melio syncs directly with QuickBooks Online, eliminating double data entry. Bills, vendors, and payment records automatically update in both platforms, streamlining your accounting workflow.

6. Role-Based Permissions

You can grant different permission levels to team members or accountants. For example, your bookkeeper can manage bills while you retain final approval rights—ensuring control without micromanagement.

How Melio Benefits SMBs

1. Better Cash Flow

Paying vendors with a credit card—even when they don’t accept them directly—means you can hold onto your cash longer. This helps maintain a healthy cash flow, especially during slow periods.

2. Time Savings

Melio removes the need for printing checks, stuffing envelopes, or manually recording transactions. Everything is managed from one dashboard, saving you hours each week.

3. Strong Vendor Relationships

Melio ensures timely and accurate payments, improving your reputation and relationships with suppliers, contractors, and landlords—even if they still rely on paper checks.

4. Full Transparency

Real-time payment tracking and automatic audit trails give you full visibility into your finances. You’ll always know what’s been paid, what’s due, and what’s scheduled.

5. Scalability

As your business grows, Melio scales with you. Its multi-user features, accounting integrations, and automation make it easy to handle an increasing volume of transactions without extra staff.

Who Should Use Melio?

Melio is ideal for:

- Freelancers and solopreneurs

- Retailers and e-commerce businesses

- Consultants and service providers

- Nonprofits and startups with lean budgets

If your business regularly sends or receives payments and you’re looking for a modern, affordable, and flexible tool, Melio is worth exploring.

Final Thoughts

Melio is more than just a payment processor—it’s a tool that helps SMBs operate more efficiently, stay organized, and improve financial health. With features like credit card payments, free ACH transfers, paper check mailing, and QuickBooks integration, Melio is making it easier than ever for small businesses to handle payments with confidence and ease.

Try Melio for free today and take control of your cash flow without extra costs.